The downturn in the real estate market is apparently convincing many consumers to rethink their priorities. Among them, homebuyers are now telling builders that more efficiently built living spaces, energy-efficient designs, and flexible floor plans are features that they want in a home.

A study released at the International Builders Show in Orlando recently showed 91% of consumers stating that they would choose a highly energy-efficient home with lower utility bills over a home without energy-efficient features that cost them 2-3% less.

Consumers also stated that the two items that would most influence their decision to purchase a new home were the living spaces and the energy-efficient features of their home. In terms of living spaces, these homebuyers prefer flexible living spaces that accommodate modern lifestyles.

In the survey, buyers further stated that they don’t necessarily prefer larger houses. Instead, they would prefer a smaller house with higher-quality amenities to a bigger house with fewer amenities.

Saturday, February 23, 2008

Saturday, February 16, 2008

"Back to the Future"- or How to Survive the Credit Crunch

The good news is that interest rates are lower than they’ve been in years, hovering around 5.6% for a 30 year, fixed-rate loan in Northeast Ohio.

The bad news is that, as the subprime crisis heats up and lenders feel the pain of foreclosures, getting a loan is getting harder – even for qualified buyers.

Nonetheless, if you are in the market to buy a home, you can take advantage of affordable home prices and low interest rates by playing it safe and smart. If you have a credit score above 620, you will generally be considered a prime customer, although other factors such as the amount of debt that you’re carrying and how much you want to borrow will factor into getting pre-approved. The biggest change is a movement by lenders away from the 100% financing that was typical just a couple of years ago. In other words, "back to the future" – a return to traditional standards in qualifying borrowers. Having a down payment, (minimum is typically 3%) should allow buyers to take advantage of the current market conditions to purchase property

at an affordable price and to get a good rate.

Why consider buying now?

According to Lawrence Yun, Chief Economist for the National Association of Realtors, "the 30 year fixed rate mortgage is forecast to rise slowly to the 5.9 percent range in the fourth quarter of 2008, and then average 6.3% in 2009."

Wednesday, February 6, 2008

Gloom? Doom?

This is what we are hearing almost every day from multiple media sources on the state of the real estate market. Unfortunately this may be true for many parts of the country when looking at a study done by Fortune Magazine that examines future real estate values in 54 metropolitan areas over the next 5 years. The good news is that Cleveland, yes Cleveland, comes out on top. Of the 54 areas in the report, all but 7 report declining values within the next 5 years. Cleveland is expected to have the largest gain followed by Indianapolis, Cincinnati, Detroit, Kansas City, Dallas/Fort Worth andHouston.

Price trends for 54 major metropolitan areas:

http://money.cnn.com/magazines/fortune/price_rent_ratios/

Price trends for 54 major metropolitan areas:

http://money.cnn.com/magazines/fortune/price_rent_ratios/

Have we hit bottom?

A new story from CNNMoney.com may suggest that we have. Cleveland which has been the poster child for the American foreclosure crisis only has one zip code in the list of the top 100 zip codes across the country for foreclosure filings in December of 2007. That zip code, 44105, which seemed to be at the top of the list for so long now comes in at only number 51. Cleveland was hit early by predatory loans that left vulnerable buyers with ridiculous fees, rising monthly payments and homes with artificially inflated values. Since we were the first, we captured the eyes of the news media from around the globe. Hopefully this recent news shed some light on what is truly a national problem. If there is a shining spot in this crisis for Cleveland, it is that the first one in is the first one out.

Tuesday, February 5, 2008

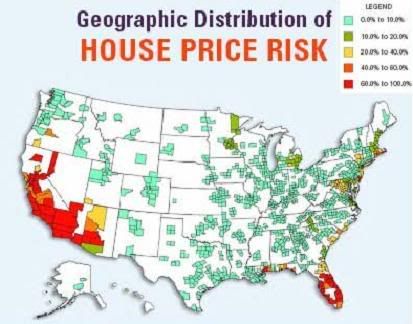

PMI Inc. "Cleveland is the 11th Safest Market in the Nation"

Greater Cleveland is the eleventh safest market in the nation according to a recent study by PMI Inc. (www.pmi-us.org), in terms of the risk of depreciation. In fact, there is a less than 1% chance that the Cleveland market will depreciate in the next two years, compared with a greater than 50% chance for some markets in California, Arizona and Florida. Greater Cleveland also ranks among the most affordable markets in the nation, with an affordability index of approximately 1.26, meaning that we have low housing costs relative to our average income. The information detailed in this report is good news for buyers and sellers in today’s real estate market. It indicates that even in the current market, one in which foreclosures and the mortgage crisis are making national headlines every day, there are many qualified buyers in Northeast Ohio, and they can still find a good deal. With interest rates well below 6% for the first time in several years, it’s a good time to buy or sell a home.

Subscribe to:

Posts (Atom)