Across the country, sale were up 44.1% from November 2008 to November 2009. Realtors attribute this to the availability of the federal tax credit for first-time homebuyers, low interest rates, price stabilization, and a generally improving economy.

According to survey information, first-time homebuyers accounted for 51% of the sales in November of 2009.

Meanwhile, rates ticked up slightly, from a national average of 4.81% to an average of 4.94%. While still at historic belows, many analysts predict that rates will continue their climb early next year, landing above 6% eventually

Housing researchers still express caution about announcing a market recovery, especially when economic indicators are mixed, housing prices remain low, sales are still sluggish when compared to pre-crash levels, and a national forelosure backlog of 1.7 million homes is sitting in the pipeline.

Tuesday, December 22, 2009

Wednesday, December 16, 2009

Campus District Concept Gains Traction in Cleveland

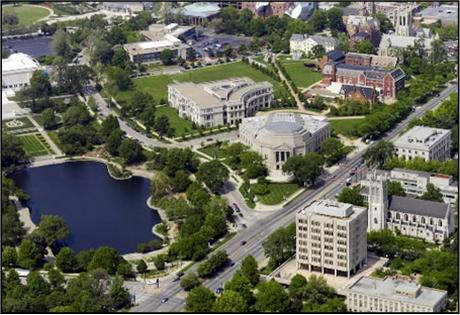

The Quadrangle takes new shape as The Campus District, just east of downtown Cleveland

By Jim Nichols, The Plain Dealer

December 9th, 2009

CLEVELAND, Ohio -- The eastern-downtown area that has long wanted to be known as The Quadrangle now has a new name: The Campus District.

It also is moving toward a much more forceful mission: To create the next big, hip and exciting destination area in Cleveland, spanning from St. Vincent Charity Hospital on the south to the lakefront on the north. Within that 500-acre swath: Cleveland State University, Cuyahoga Community College and a sea of disconnected, underdeveloped neighborhoods, property and people.

The community development corporation now known as The Campus District can -- and must -- plow away the malaise and sew together the sprawling corridor along East 22nd Street, consultant Chris Ronayne told its board today.

The keys he identified to doing that: creating a new a streetscape spine bridging the Innerbelt, and combining the power of the institutions along that corridor into a redefined authority with new powers -- including the power to buy and redevelop land.

All of that will translate into new people -- new residents to repopulate the eastern fringe of Cleveland's central business district, said Ronayne, who is president of University Circle Inc. and formerly was a top City Hall official.

"We've got some real possibilities," Ronayne told board members and guests at the organization's annual meeting at The Plain Dealer.

When Ronayne finished his presentation, the former Quadrangle board voted unanimously to change a name that has never really gotten city-wide traction or identity.

Whether that board and the businesses, colleges and nonprofits it represents will rise to new prominence and power remains to be seen, said Campus District Inc. board member David Chilcote, president of The Chilcote Co. near CSU.

"Everybody has their own interests and agendas, but this is a good start," Chilcote said in an interview.

Among the "connection" strategies Ronayne said the organization should focus on:

•Persuading the Ohio Department of Transportation to build a "cap" over the Inner Belt at East 22nd Street. Columbus has already accomplished this over its Interstate 670 just north of downtown, Ronayne said. Doing so here would heal Interstate 90's deep cut between downtown and the fast-growing, 5,000-employee area around Tri-C and St. Vincent.

•Turning East 22nd into a two-way pedestrian- and bike-friendly "main street" into the CSU campus and downtown -- a north-south copy of, and complement to, the new Euclid Avenue.

•Extending the Regional Transit Authority's free E-Line trolley-bus line up East 22nd from Euclid Avenue to Orange Avenue to create a continuous loop between Public Square and the hospital/Tri-C campuses.

•Expanding the Campus District's staff, budget and authority so that the agency can offer new services to members -- lobbying, cohesive development planning, community affairs, endowment-building and grant-making, and special "signature" events such as a neighborhood fair. Ronayne suggested copying University Circle Inc.

The organization should conceive of a way to fund that expansion through dues, property assessments or fees for services, Ronayne suggested. Then it should work with developers to build according to unified design standards, and also work to promote a new image, or brand, for the area.

A start: today's launch of the new Web site: http//campusdistrict.org

Ronayne contended that a successful Campus District brand, and the progress needed to create and burnish it, could help counter the government bias toward suburban sprawl, which he called "one of the root causes of the financial meltdown of the last two years."

Urged Ronayne: "Make it a live-work space. Make it known. Brand the heck out of it, and sell, sell, sell this place."

Ward 5 City Councilwoman Phyllis Cleveland said she was excited at what she heard.

"It is a great vision," she said. "And we're at a point where we all realize we're on the same page, all dependent on one another and on the verge of doing some really good things here."

By Jim Nichols, The Plain Dealer

December 9th, 2009

CLEVELAND, Ohio -- The eastern-downtown area that has long wanted to be known as The Quadrangle now has a new name: The Campus District.

It also is moving toward a much more forceful mission: To create the next big, hip and exciting destination area in Cleveland, spanning from St. Vincent Charity Hospital on the south to the lakefront on the north. Within that 500-acre swath: Cleveland State University, Cuyahoga Community College and a sea of disconnected, underdeveloped neighborhoods, property and people.

The community development corporation now known as The Campus District can -- and must -- plow away the malaise and sew together the sprawling corridor along East 22nd Street, consultant Chris Ronayne told its board today.

The keys he identified to doing that: creating a new a streetscape spine bridging the Innerbelt, and combining the power of the institutions along that corridor into a redefined authority with new powers -- including the power to buy and redevelop land.

All of that will translate into new people -- new residents to repopulate the eastern fringe of Cleveland's central business district, said Ronayne, who is president of University Circle Inc. and formerly was a top City Hall official.

"We've got some real possibilities," Ronayne told board members and guests at the organization's annual meeting at The Plain Dealer.

When Ronayne finished his presentation, the former Quadrangle board voted unanimously to change a name that has never really gotten city-wide traction or identity.

Whether that board and the businesses, colleges and nonprofits it represents will rise to new prominence and power remains to be seen, said Campus District Inc. board member David Chilcote, president of The Chilcote Co. near CSU.

"Everybody has their own interests and agendas, but this is a good start," Chilcote said in an interview.

Among the "connection" strategies Ronayne said the organization should focus on:

•Persuading the Ohio Department of Transportation to build a "cap" over the Inner Belt at East 22nd Street. Columbus has already accomplished this over its Interstate 670 just north of downtown, Ronayne said. Doing so here would heal Interstate 90's deep cut between downtown and the fast-growing, 5,000-employee area around Tri-C and St. Vincent.

•Turning East 22nd into a two-way pedestrian- and bike-friendly "main street" into the CSU campus and downtown -- a north-south copy of, and complement to, the new Euclid Avenue.

•Extending the Regional Transit Authority's free E-Line trolley-bus line up East 22nd from Euclid Avenue to Orange Avenue to create a continuous loop between Public Square and the hospital/Tri-C campuses.

•Expanding the Campus District's staff, budget and authority so that the agency can offer new services to members -- lobbying, cohesive development planning, community affairs, endowment-building and grant-making, and special "signature" events such as a neighborhood fair. Ronayne suggested copying University Circle Inc.

The organization should conceive of a way to fund that expansion through dues, property assessments or fees for services, Ronayne suggested. Then it should work with developers to build according to unified design standards, and also work to promote a new image, or brand, for the area.

A start: today's launch of the new Web site: http//campusdistrict.org

Ronayne contended that a successful Campus District brand, and the progress needed to create and burnish it, could help counter the government bias toward suburban sprawl, which he called "one of the root causes of the financial meltdown of the last two years."

Urged Ronayne: "Make it a live-work space. Make it known. Brand the heck out of it, and sell, sell, sell this place."

Ward 5 City Councilwoman Phyllis Cleveland said she was excited at what she heard.

"It is a great vision," she said. "And we're at a point where we all realize we're on the same page, all dependent on one another and on the verge of doing some really good things here."

Wednesday, December 2, 2009

Universitycirclecondos.com - a neighborhood and real estate guide brought to you by you know who

Progressive Urban Real Estate's new website features neighborhood and real estate guides that include a history of each community, a list of features and amenities, and a desciption of available housing options including new developments. Check it out at http://www.universitycirclecondos.com. On the PURE website, you can also learn about other neighborhoods in the city of Cleveland, as well as inner ring suburbs such as Cleveland Heights.

Wednesday, November 18, 2009

Cleveland Ranked Among the Smartest and Safest U.S. Cities

The Daily Beast determined their list of the smartest US cities by looking at a variety of factors, such as nonfiction book sales, the ratio of higher education institutions, and political engagement. Cleveland was given a score of 97 and ranked 31st (tied with West Palm Beach) out of 56 cities that were ranked. The Daily Beast listed Case Western Reserve University as one of the Cleveland's strong points.

The study by Forbes Magazine determined that Cleveland is the 10th safest city in the US. To determine the list, Forbes looked at the country's 40 largest metropolitan statistical areas across four categories of danger: violent crime rates from the FBI's 2008 uniform crime report, 2008 workplace death rates from the Bureau of Labor Statistics, 2008 traffic death rates from the National Highway Traffic Safety Administration, and natural disaster risk, using rankings from green living site SustainLane. Cleveland was ranked behind cities such as Minneapolis-St. Paul, Milwaukee, Portland, Boston and only a few others.

The study by Forbes Magazine determined that Cleveland is the 10th safest city in the US. To determine the list, Forbes looked at the country's 40 largest metropolitan statistical areas across four categories of danger: violent crime rates from the FBI's 2008 uniform crime report, 2008 workplace death rates from the Bureau of Labor Statistics, 2008 traffic death rates from the National Highway Traffic Safety Administration, and natural disaster risk, using rankings from green living site SustainLane. Cleveland was ranked behind cities such as Minneapolis-St. Paul, Milwaukee, Portland, Boston and only a few others.

Tuesday, November 17, 2009

I will stay if ... Cleveland Edition!

FOR IMMEDIATE RELEASE

“I Will Stay If...” CLEVELAND Edition

A local event connected with GLUE’s “I Will Stay If…” campaign.

On Wednesday, November 18th, 2009, GLUE (Great Lakes Urban Exchange) invites you to join community members and leaders in a conversation about what makes a city sustainable, the continuing issues and challenges facing our city, and the new developments that are putting Cleveland on the map. What will make YOU stay? What IS making you stay? We want to know!

We invite all Clevelanders to join us for an evening of networking and idea-sharing. Co-sponsored by http://www.facebook.com/l/b40d4;Cleveland365.com, this unique and high energy event will feature dynamic speakers and an interesting forum for young professionals and community members to talk about new and exciting happenings in Cleveland. Participants in the program include Matt Zone, Ward 17 Councilman and driving force behind the new Gordon Square Arts District; Randell McShepard, VP of Public Affairs at RPM International, Inc., co-founder and chairman of PolicyBridge; and Lillian A. Kuri, Program Director for Architecture, Urban Design and Sustainable Development for the Cleveland Foundation and key player in the Greater University Circle initiative.

The Great Lakes Urban Exchange (GLUE) was founded by a Pittsburgher and a Detroiter to catalyze conversations across Rust Belt communities about (among other things) the loss of population and sustainable economic activity. After two years of hosting multi-state conferences, building networks online, and creating opportunities for urbanists across the region to connect with a variety of policy and organizing experts, GLUE launched its “I Will Stay If…” (IWSI) campaign in Detroit earlier this summer. Pittsburgh’s event “Why Pittsburgh?” was held in September. (http://www.facebook.com/l/b40d4;rustwire.com/2009/09/14/i-will-stay-if-comes-to-pittsburgh/) Cleveland is the third GLUE city to host an event and plans for similar parties in Buffalo and Milwaukee are in the works.

IWSI parties aim to bring together a diverse crowd of people in a GLUE city to participate in this vital conversation. In Cleveland, we want to know not only what will make you stay, but what is working for you already. Why are you here? How can we attract others like you? We are documenting the answers you give through a photographic exhibit that will travel our region. Eventually, GLUE will use the photographs as a non-traditional data set to share with policymakers. In the meantime, this event is an opportunity to celebrate everything that makes our city special, and the reasons we live here.

Cleveland’s own IWSI party, “I Will Stay If…” Cleveland Edition will take place at Speakeasy (1948 W. 25th Street-under the Bier Markt, 44113, http://www.facebook.com/l/b40d4;speakeasy216.com) on Wednesday November 18 from 5:30 – 8:30 PM. Please join us and participate in the IWSI documentary project with acclaimed local photographers Bryon Miller and Suzanne Cofer. Food and drink specials are available to event participants. $5 suggested donations are welcome at the door. For more information about GLUE, please visit http://www.facebook.com/l/b40d4;gluespace.org. To learn more about what’s behind IWSI, please visit http://www.facebook.com/l/b40d4;iwillstayif.org. For donor, organization and event information please visit our website http://www.facebook.com/l/b40d4;iwsicleveland.blogspot.com or contact iwsicleveland@gmail.com.

“I Will Stay If...” CLEVELAND Edition

A local event connected with GLUE’s “I Will Stay If…” campaign.

On Wednesday, November 18th, 2009, GLUE (Great Lakes Urban Exchange) invites you to join community members and leaders in a conversation about what makes a city sustainable, the continuing issues and challenges facing our city, and the new developments that are putting Cleveland on the map. What will make YOU stay? What IS making you stay? We want to know!

We invite all Clevelanders to join us for an evening of networking and idea-sharing. Co-sponsored by http://www.facebook.com/l/b40d4;Cleveland365.com, this unique and high energy event will feature dynamic speakers and an interesting forum for young professionals and community members to talk about new and exciting happenings in Cleveland. Participants in the program include Matt Zone, Ward 17 Councilman and driving force behind the new Gordon Square Arts District; Randell McShepard, VP of Public Affairs at RPM International, Inc., co-founder and chairman of PolicyBridge; and Lillian A. Kuri, Program Director for Architecture, Urban Design and Sustainable Development for the Cleveland Foundation and key player in the Greater University Circle initiative.

The Great Lakes Urban Exchange (GLUE) was founded by a Pittsburgher and a Detroiter to catalyze conversations across Rust Belt communities about (among other things) the loss of population and sustainable economic activity. After two years of hosting multi-state conferences, building networks online, and creating opportunities for urbanists across the region to connect with a variety of policy and organizing experts, GLUE launched its “I Will Stay If…” (IWSI) campaign in Detroit earlier this summer. Pittsburgh’s event “Why Pittsburgh?” was held in September. (http://www.facebook.com/l/b40d4;rustwire.com/2009/09/14/i-will-stay-if-comes-to-pittsburgh/) Cleveland is the third GLUE city to host an event and plans for similar parties in Buffalo and Milwaukee are in the works.

IWSI parties aim to bring together a diverse crowd of people in a GLUE city to participate in this vital conversation. In Cleveland, we want to know not only what will make you stay, but what is working for you already. Why are you here? How can we attract others like you? We are documenting the answers you give through a photographic exhibit that will travel our region. Eventually, GLUE will use the photographs as a non-traditional data set to share with policymakers. In the meantime, this event is an opportunity to celebrate everything that makes our city special, and the reasons we live here.

Cleveland’s own IWSI party, “I Will Stay If…” Cleveland Edition will take place at Speakeasy (1948 W. 25th Street-under the Bier Markt, 44113, http://www.facebook.com/l/b40d4;speakeasy216.com) on Wednesday November 18 from 5:30 – 8:30 PM. Please join us and participate in the IWSI documentary project with acclaimed local photographers Bryon Miller and Suzanne Cofer. Food and drink specials are available to event participants. $5 suggested donations are welcome at the door. For more information about GLUE, please visit http://www.facebook.com/l/b40d4;gluespace.org. To learn more about what’s behind IWSI, please visit http://www.facebook.com/l/b40d4;iwillstayif.org. For donor, organization and event information please visit our website http://www.facebook.com/l/b40d4;iwsicleveland.blogspot.com or contact iwsicleveland@gmail.com.

Friday, November 13, 2009

Rates on 30-Year Loans Remain Below 5%

Rates on 30-year loans remain below 5%

By Associated Press business staff

WASHINGTON -- Rates this week for 30-year home loans stayed below 5 percent for the second week in a row.

The average rate fell to 4.91 percent from 4.98 percent a week earlier, mortgage company Freddie Mac said Thursday.

Rates hit a record low of 4.78 percent in the spring, but are still attractive for people looking to buy a home or refinance.

The Federal Reserve has pumped $1.25 trillion into mortgage-backed securities to try to lower rates on mortgages and loosen credit. Rates on 30-year mortgages traditionally track yields on long-term government debt.

Last week, Congress passed a bill extending and expanding a key federal tax credit that has helped to boost sales.

Buyers who have owned their current homes at least five years would be eligible for tax credits of up to $6,500. First-time homebuyers -- or anyone who hasn't owned a home in the last three years -- would still get up to $8,000. To qualify, buyers have to sign a purchase agreement by April 30, 2010 and close by June 30.

However, lenders remain cautious and credit standards are tough, so the best rates are available only to borrowers with solid credit and a 20 percent down payment.

Recent data show a housing market on the mend. The National Association of Realtors said Tuesday that third-quarter home sales outpaced the previous three months and the year-ago figures, and price declines are moderating. The same day, homebuilder Toll Brothers Inc. said contracts for new homes rose 42 percent in its fiscal fourth quarter.

Freddie Mac collects mortgage rates on Monday through Wednesday of each week from lenders around the country. Rates often fluctuate significantly, even within a given day, frequently in line with long-term Treasury bonds.

The average rate on a 15-year fixed-rate mortgage fell to 4.36 percent from 4.40 percent recorded last week, according to Freddie Mac.

Rates on five-year, adjustable-rate mortgages averaged 4.29 percent, down from last week's 4.35 percent. Rates on one-year, adjustable-rate mortgages declined to 4.46 percent from 4.47 percent.

The rates do not include add-on fees known as points. The nationwide fee for loans in Freddie Mac's survey averaged 0.7 point for 30-year loans. The fee averaged 0.6 point for 15-year, five-year and one-year loans.

Friday, November 6, 2009

Obama Signs Homebuyers, Jobless Assistance Bill

Obama signs homebuyer, jobless bill assistance

By JIM ABRAMS

Associated Press Writer

WASHINGTON (AP) -- President Barack Obama signed a $24 billion economic stimulus bill into law Friday, giving tax incentives to prospective homebuyers and additional jobless benefits to those idled by the business slump.

The bill-signing came a day after the House, displaying rare bipartisan agreement over the troubling employment picture nationally, voted 403-12 to pass the measure. The Senate had approved it unanimously on Wednesday.

The White House said the law, which also includes tax cuts for struggling businesses, builds on provisions in the $787 billion stimulus package enacted last February to avert an economic meltdown.

"The need for such a measure was made clear by the jobs report that we received this morning," Obama said, citing Friday's government report the jobless rate hit 10.2 percent last month, the highest since 1983.

He called it a "sobering number that underscores the economic challenges that lie ahead" and vowed that "I will not rest until all Americans who want work can find work."

For their part, lawmakers stressed that the fourth unemployment benefit extension in the past 18 months was necessary because initial signs of economic recovery have not been reflected in the job market.

"The truth is that long-term unemployment remains at its highest rate since we began measuring it in 1948," said House Majority Leader Steny Hoyer, D-Md. About a third of the 15 million people out of work have gone at least six months without a job.

The law provides another 14 weeks of benefits to all out-of-work people who have exhausted their benefits or will do so by the end of the year, estimated at nearly 2 million. Those in states where the jobless rate is 8.5 percent or above get an additional six weeks.

The Labor Department reported Friday that that employers shed another 190,000 jobs in October. Obama said job creation traditionally lags behind economic growth, but he acknowledged that is small comfort to those seeking work.

"So although it will take time and it will take patience, I am confident that our economy will recover," Obama said. "I'm confident that we're moving in the right direction. And I promise that I won't rest until America prospers once again."

Later, presidential spokesman Robert Gibbs sought to put the unemployment numbers in context.

"You've heard me say for months that we believe that 10 percent was going to come," Gibbs said. He said the White House is heartened by the decrease in unemployment claims and the fact that, overall, the economy is growing again.

"But I believe - I think most would tell you - that the (unemployment) rate is more likely than not to get a little worse before it gets better," Gibbs said.

The extra 20 weeks could push the maximum a person in a high unemployment state could receive to 99 weeks, the most in history. Unemployment checks generally are for about $300 a week.

The tax credits, added by the Senate, center on extending the popular $8,000 credit for first-time homebuyers that was included in the stimulus package. The credit, which was to expire at the end of this month, will be available through next June as long as the buyer signs a binding contract by the end of April.

The program is expanded to include a $6,500 credit for existing homeowners who buy a new place after living in their current residence for at least five years.

The cost of the unemployment benefit extension, about $2.4 billion, is offset by extending a federal unemployment tax that employers must pay.

---

The bill is H.R. 3548.

By JIM ABRAMS

Associated Press Writer

WASHINGTON (AP) -- President Barack Obama signed a $24 billion economic stimulus bill into law Friday, giving tax incentives to prospective homebuyers and additional jobless benefits to those idled by the business slump.

The bill-signing came a day after the House, displaying rare bipartisan agreement over the troubling employment picture nationally, voted 403-12 to pass the measure. The Senate had approved it unanimously on Wednesday.

The White House said the law, which also includes tax cuts for struggling businesses, builds on provisions in the $787 billion stimulus package enacted last February to avert an economic meltdown.

"The need for such a measure was made clear by the jobs report that we received this morning," Obama said, citing Friday's government report the jobless rate hit 10.2 percent last month, the highest since 1983.

He called it a "sobering number that underscores the economic challenges that lie ahead" and vowed that "I will not rest until all Americans who want work can find work."

For their part, lawmakers stressed that the fourth unemployment benefit extension in the past 18 months was necessary because initial signs of economic recovery have not been reflected in the job market.

"The truth is that long-term unemployment remains at its highest rate since we began measuring it in 1948," said House Majority Leader Steny Hoyer, D-Md. About a third of the 15 million people out of work have gone at least six months without a job.

The law provides another 14 weeks of benefits to all out-of-work people who have exhausted their benefits or will do so by the end of the year, estimated at nearly 2 million. Those in states where the jobless rate is 8.5 percent or above get an additional six weeks.

The Labor Department reported Friday that that employers shed another 190,000 jobs in October. Obama said job creation traditionally lags behind economic growth, but he acknowledged that is small comfort to those seeking work.

"So although it will take time and it will take patience, I am confident that our economy will recover," Obama said. "I'm confident that we're moving in the right direction. And I promise that I won't rest until America prospers once again."

Later, presidential spokesman Robert Gibbs sought to put the unemployment numbers in context.

"You've heard me say for months that we believe that 10 percent was going to come," Gibbs said. He said the White House is heartened by the decrease in unemployment claims and the fact that, overall, the economy is growing again.

"But I believe - I think most would tell you - that the (unemployment) rate is more likely than not to get a little worse before it gets better," Gibbs said.

The extra 20 weeks could push the maximum a person in a high unemployment state could receive to 99 weeks, the most in history. Unemployment checks generally are for about $300 a week.

The tax credits, added by the Senate, center on extending the popular $8,000 credit for first-time homebuyers that was included in the stimulus package. The credit, which was to expire at the end of this month, will be available through next June as long as the buyer signs a binding contract by the end of April.

The program is expanded to include a $6,500 credit for existing homeowners who buy a new place after living in their current residence for at least five years.

The cost of the unemployment benefit extension, about $2.4 billion, is offset by extending a federal unemployment tax that employers must pay.

---

The bill is H.R. 3548.

Friday, October 30, 2009

IRS Flooded With Tax Credit Requests, Slowing Process; Fraud Investigations Underway

From the Cleveland Plain Dealer

cleveland.com/realestatenews

CLEVELAND, Ohio -- Some home buyers who have requested a much-touted federal income tax credit are having to wait months to receive a refund check from the IRS.

A flood of amended tax returns and concerns about fraud have slowed the process for claiming the credit, which is aimed at first-time buyers.

As Congress works out the details of prolonging and expanding the credit offer, set to expire at the end of November, legislators are grappling with ways to make the program more efficient and less open to manipulation.

More than 1.4 million taxpayers have claimed upwards of $10 billion since 2008, when the government began offering a $7,500 credit -- a loan, really -- to people who had not owned a home in at least three years. Buyers would repay the money over 15 years. This year, Congress sweetened the package, turning the loan into an $8,000 tax credit that did not need to be repaid. To keep the cash, buyers just needed to stay in the home for three years.

The result: A boost for the moribund housing market. But along with that came a rash of fraud and innocent mistakes as people who were not qualified for the credit requested -- and received -- free government cash.

BY THE NUMBERS

A federal income tax credit has been available to first-time home buyers since 2008. It is set to expire Nov. 30.

Number of U.S. taxpayers claiming the credit:

1,426,554

Dollar amount:

$9.998 billion

Number of Ohioans claiming the credit:

48,776

Dollar amount:

$326.5 million

National rank: 33rd in terms of dollars per capita

SOURCE: Government Accountability Office (data through Aug. 22)

The Internal Revenue Service already has identified more than 160 possible fraud schemes, Linda Stiff, the agency's deputy commissioner for services and enforcement, told a U.S. House subcommittee last week. The IRS also is reviewing more than 100,000federal income tax returns that involve claims for the credit.

Recent government reports pointed out thousands of questionable claims, representing hundreds of millions of dollars. Some of the claims were filed by IRS employees. Others involved taxpayers as young as 4 years old.

As the IRS has added more fraud checks to its system, taxpayers are waiting longer for their money.

"We were getting the refunds in six weeks, and now it's taking about 20 weeks," said Marilyn Meredith, an enrolled agent who prepares tax returns in Port Huron, Mich. "The last two months is when it has really increased a lot."

Most people who buy houses this year are expected to request the credit on their 2009federal income tax return, filed in 2010. The IRS will apply the credit to whatever taxes a buyer owes and send the buyer a check for the difference. But buyers who want cash sooner have been amending their 2008 tax returns.

Those amended tax returns are filed on paper and processed manually. They go into a pool with other amended returns. The IRS receives 5 million to 7 million such returns each year, a spokesman said. Some buyers who asked for the credit in the spring are just hearing back from the IRS. And taxpayers who call to check on their refunds are being told to wait another few weeks, due to a backlog of returns and safeguards for fraud.

Filing for the credit requires no documentation of a home purchase. The form taxpayers fill out does not verify that they have not owned a home during the past three years -- a prerequisite for the credit. It asks only for the address of the home, the date of the purchase and the amount of the anticipated tax credit.

Rich Rhodes, an enrolled agent in Hinckley, tried to expedite a client's credit request by sending the IRS a settlement statement -- proof that his client bought the home. Meredith also has been attaching these statements to tax returns and writing on the forms that her clients have not owned a home in three years.

Some taxpayers are confused and probably are making mistakes on their returns, tax professionals said. People think they can request the credit before they buy a house -- not true. Others believe they can buy a home from a family member -- also prohibited.

In other cases, people are trying to fool the government. Jeffrey Schneider, an enrolled agent in south Florida, dumped two clients after they asked him to wrongly claim the credit on their tax returns. He wasn't surprised by the attempts to game a system that offers free money and requires little documentation.

"From what I've been reading, the IRS has egg on their face, all over them, because they put this nice credit out there and they get bombarded with fraud," he said.

Rep. John Lewis, a Georgia Democrat, has introduced legislation to clear up some of those problems. His bill would require taxpayers filing for the credit to be older than 18 and to provide proof of their purchase. The legislation also aims to make it easier for the IRS to run the program and to check for fraud.

A local IRS spokesman would not comment on the fraud issues. During her testimony to legislators, the IRS's Stiff said the agency will keep pursuing people who wrongly request the credit. But, she said, "We cannot let fraudulent activity undermine a program that has benefited so many."

cleveland.com/realestatenews

CLEVELAND, Ohio -- Some home buyers who have requested a much-touted federal income tax credit are having to wait months to receive a refund check from the IRS.

A flood of amended tax returns and concerns about fraud have slowed the process for claiming the credit, which is aimed at first-time buyers.

As Congress works out the details of prolonging and expanding the credit offer, set to expire at the end of November, legislators are grappling with ways to make the program more efficient and less open to manipulation.

More than 1.4 million taxpayers have claimed upwards of $10 billion since 2008, when the government began offering a $7,500 credit -- a loan, really -- to people who had not owned a home in at least three years. Buyers would repay the money over 15 years. This year, Congress sweetened the package, turning the loan into an $8,000 tax credit that did not need to be repaid. To keep the cash, buyers just needed to stay in the home for three years.

The result: A boost for the moribund housing market. But along with that came a rash of fraud and innocent mistakes as people who were not qualified for the credit requested -- and received -- free government cash.

BY THE NUMBERS

A federal income tax credit has been available to first-time home buyers since 2008. It is set to expire Nov. 30.

Number of U.S. taxpayers claiming the credit:

1,426,554

Dollar amount:

$9.998 billion

Number of Ohioans claiming the credit:

48,776

Dollar amount:

$326.5 million

National rank: 33rd in terms of dollars per capita

SOURCE: Government Accountability Office (data through Aug. 22)

The Internal Revenue Service already has identified more than 160 possible fraud schemes, Linda Stiff, the agency's deputy commissioner for services and enforcement, told a U.S. House subcommittee last week. The IRS also is reviewing more than 100,000federal income tax returns that involve claims for the credit.

Recent government reports pointed out thousands of questionable claims, representing hundreds of millions of dollars. Some of the claims were filed by IRS employees. Others involved taxpayers as young as 4 years old.

As the IRS has added more fraud checks to its system, taxpayers are waiting longer for their money.

"We were getting the refunds in six weeks, and now it's taking about 20 weeks," said Marilyn Meredith, an enrolled agent who prepares tax returns in Port Huron, Mich. "The last two months is when it has really increased a lot."

Most people who buy houses this year are expected to request the credit on their 2009federal income tax return, filed in 2010. The IRS will apply the credit to whatever taxes a buyer owes and send the buyer a check for the difference. But buyers who want cash sooner have been amending their 2008 tax returns.

Those amended tax returns are filed on paper and processed manually. They go into a pool with other amended returns. The IRS receives 5 million to 7 million such returns each year, a spokesman said. Some buyers who asked for the credit in the spring are just hearing back from the IRS. And taxpayers who call to check on their refunds are being told to wait another few weeks, due to a backlog of returns and safeguards for fraud.

Filing for the credit requires no documentation of a home purchase. The form taxpayers fill out does not verify that they have not owned a home during the past three years -- a prerequisite for the credit. It asks only for the address of the home, the date of the purchase and the amount of the anticipated tax credit.

Rich Rhodes, an enrolled agent in Hinckley, tried to expedite a client's credit request by sending the IRS a settlement statement -- proof that his client bought the home. Meredith also has been attaching these statements to tax returns and writing on the forms that her clients have not owned a home in three years.

Some taxpayers are confused and probably are making mistakes on their returns, tax professionals said. People think they can request the credit before they buy a house -- not true. Others believe they can buy a home from a family member -- also prohibited.

In other cases, people are trying to fool the government. Jeffrey Schneider, an enrolled agent in south Florida, dumped two clients after they asked him to wrongly claim the credit on their tax returns. He wasn't surprised by the attempts to game a system that offers free money and requires little documentation.

"From what I've been reading, the IRS has egg on their face, all over them, because they put this nice credit out there and they get bombarded with fraud," he said.

Rep. John Lewis, a Georgia Democrat, has introduced legislation to clear up some of those problems. His bill would require taxpayers filing for the credit to be older than 18 and to provide proof of their purchase. The legislation also aims to make it easier for the IRS to run the program and to check for fraud.

A local IRS spokesman would not comment on the fraud issues. During her testimony to legislators, the IRS's Stiff said the agency will keep pursuing people who wrongly request the credit. But, she said, "We cannot let fraudulent activity undermine a program that has benefited so many."

Wednesday, October 28, 2009

Buy This Renovated Home and Walk to the Brand New Capitol Theatre! (OK, Subtlety Is Not Our Strong Suit)

Last week, we wrote about the foreclosure rehab initiative that was spearheaded by four individuals at PURE and Civic Builders. We renovated, marketed and sold two of the three rehabbed homes in a down market. We're proud that we've added two new homeowners to the city of Cleveland, and renovated two houses that were previously in a sad, neglected state.

But we're not finished yet. We still have one house to go, located at 7212 West Clinton Avenue on one of the best streets in the Detroit Shoreway neighborhood (and indeed, in the entire city). This street is walkable, full of homeowners and great neighbors, loaded with classic architecture and rehabbed homes, and steps away from the west side's newest arts movie theatre, the Capitol Theatre.

Inside, we've transformed the classic West Clinton colonial floor plan into a modern house, while retaining its historic features. The house has refinished top-nailed wood floors, a completely new, energy efficient mechanical system, a spacious floor plan, four bedrooms and two and a half baths. The master bedroom suite features a walk-in closet and a large, adjacent bathroom with a jetted tub and a beautiful walk-in shower. The fourth floor bonus room/media room/extra bedroom offers skylights with views of Lake Erie.

Please help us spread the word about this wonderful, rehabbed home. We'd like to sell it and add one more new homeowner to the city of Cleveland!

But we're not finished yet. We still have one house to go, located at 7212 West Clinton Avenue on one of the best streets in the Detroit Shoreway neighborhood (and indeed, in the entire city). This street is walkable, full of homeowners and great neighbors, loaded with classic architecture and rehabbed homes, and steps away from the west side's newest arts movie theatre, the Capitol Theatre.

Inside, we've transformed the classic West Clinton colonial floor plan into a modern house, while retaining its historic features. The house has refinished top-nailed wood floors, a completely new, energy efficient mechanical system, a spacious floor plan, four bedrooms and two and a half baths. The master bedroom suite features a walk-in closet and a large, adjacent bathroom with a jetted tub and a beautiful walk-in shower. The fourth floor bonus room/media room/extra bedroom offers skylights with views of Lake Erie.

Please help us spread the word about this wonderful, rehabbed home. We'd like to sell it and add one more new homeowner to the city of Cleveland!

Tuesday, October 20, 2009

Two Down, One To Go: Foreclosure Rehab Initiative Successful in a Down Economy

A little over a year ago, three staff from Progressive Urban Real Estate (Lee Chilcote, Dave Sharkey and Keith Brown) and the owner of Civic Builders (Dave Fragapane) started a small rehab company. We wanted to purchase distressed properties in urban neighborhoods that, despite the downturn in the housing market and the economy, had remained strong and in demand. So we bought three homes - 3804 Whitman Ave. in Ohio City, 1302 Mentor Ave. in Tremont, and 7212 West Clinton Ave. in Detroit Shoreway.

A year later, we've sold two of the homes and are putting the final touches on 7212 West Clinton Ave., which is priced at $149,900 and remains available. Our efforts prove that, while far from easy, it's possible to rehab and sell distressed/foreclosed properties to new owners, even in our current economy.

We did so without any subsidy of the rehab costs. Much thanks to Cleveland Action to Support Housing (CASH) for writing down the interest rate on our construction loan, and to Shorebank for providing the construction financing and taking chances in a volatile market.

As a result of our efforts, three vacant and foreclosed homes have now been beautifully rehabbed - and two of the three are now occupied by new homeowners and residents of the city of Cleveland!

The above photo is an interior photo of 1302 Mentor after it was rehabbed, before the new owner moved in.

Friday, October 16, 2009

Detroit Shoreway's Capitol Theatre Opens to Great Fanfare

It's show time! Capitol Theatre reopening means flicks and fun on the West Side

By Clint O'Connor, The Plain Dealer

The opening of a movie theater is not typically a five-star event. But when it's in Cleveland, as opposed to some distant shopping mall, and when it's expected to ignite 15 blocks worth of civic revitalization, it's a rare beast indeed.

Like so many well-intentioned, let's-bring-back-the-city crusades that have sprinkled ethereal hope dust over Cleveland for the past 30 years, the restoration of the Capitol Theatre could have taken a big, fat belly-flop into the cesspool of broken dreams.

But no.

This elaborate renovation project connecting Cleveland's past with its future actually succeeded. The new Capitol, at 1390 West 65th Street just north of Detroit Avenue, opens next weekend.

For the city's cultural and nightlife scene, the theater represents something film fans have been requesting for years: a movie house on the West Side that's convenient for Clevelanders, within striking distance of Lakewood and Rocky River, and one that might offer the independent and foreign fare available for decades at the Cedar Lee Theatre in Cleveland Heights.

The project worked for two reasons, according to Jeffrey Ramsey, executive director of the Detroit Shoreway Community Development Organization. One was fresh financial sources: the federal New Market Tax Credit and Ohio's Historic Tax Credit.

The other reason: "This is not a stand-alone theater," he said. "It is part of a partnership with Cleveland Public Theatre, the Near West Theatre and the neighborhood."

If it had just been the Capitol Theatre, said Ramsey, it never would have happened.

Loads of determined folks within his organization and the Gordon Square Arts District, which runs along Detroit Avenue from West 58th Street to West 73rd Street, made it a reality, along with about $7.5 million from the tax credits, a city of Cleveland loan and grants from Cuyahoga County, the Cleveland Foundation and the Ohio Cultural Facilities Commission.

Organizers hope the sparkling movie house, which took 16 months to renovate and will employ about 20 people, draws film-goers who will spill into shops, restaurants, galleries and bars in the neighborhood before and after shows. The area is already on the rise with choice eateries, such as Luxe, La Boca and Stone Mad Irish Pub, drawing good crowds.

Wednesday, October 7, 2009

A Historic Time to Buy

Young people just starting to invest and buying their first homes are potentially the winners in this recession.

First-time homebuyers, most between the ages of 25 and 45, accounted for about 45 percent of home sales from January through July 2009, according to the National Association of REALTORS®

"This is a historic time," says George Jaramillo, a 35-year-old business analyst in Atlanta, who recently bought three homes, two of them foreclosures. "It's a great opportunity to make some great gains in the future."

A study by investment company T. Rowe Price points out that investing when prices are low can result in amazing gains. For instance, between 1970 and 1990, the annualized rate of return for the S&P 500 was 11.5 percent.

"We need to be shouting from the rooftops that this is not the time to get out of the market if you're young," says Christine Fahlund, a senior financial planner with T. Rowe Price. "This is the time to be in the market."

Reprinted from www.realtor.com.

Wednesday, September 30, 2009

Cleveland Lands 2014 Gay Games

COLOGNE, Germany — The Federation of Gay Games announced this afternoon that Cleveland will be the site of the 2014 games.

The city was chosen over Boston and Washington, D.C., after a year-long site-selection process, the organization said in a news release.

"Cleveland demonstrated to the Federation of Gay Games that they understood the mission of the Gay Games and our principles of ‘Participation, Inclusion, and Personal Best’," said Kurt Dahl, of Chicago, and Emy Ritt, of Paris, FGG Co-presidents.

"We were highly impressed by the facilities and infrastructure, the widespread community support, their financial plan and the city’s experience in hosting large scale sports and cultural events."

Mayor Frank Jackson said the city "is prepared to roll out the welcome mat to the LGBT athletes, their families and spectators from around the world. Fans of the Gay Games will find that Cleveland is a great place to celebrate sports and culture and that we have tremendous assets and amenities for them to enjoy. The sports and cultural environment here is truly a uniquely Cleveland experience, one they will cherish for years to come."

Cleveland’s 2014 Gay Games IX Sports & Cultural Festival is set for Aug. 9 through Aug. 16, 2014. It will include 30 sports, four cultural events, opening and closing ceremonies and cultural events.

"Gay Games generate $50 million to $80 million in estimated local economic impact in addition to significant ongoing travel and tourism visibility benefits for the host city," the FGG said in the news release.

Friday, September 25, 2009

36 Hours in Cleveland: NY Times Admires Cleveland's Entrepreneurial Spirit, Bohemian Dreamers

September 20, 2009

36 Hours in Cleveland

By BRETT SOKOL

“YOU Gotta Be Tough” was a popular T-shirt slogan worn by Clevelanders during the 1970s, a grim period marked by industrial decline, large-scale population flight and an urban environment so toxic the Cuyahoga River actually caught on fire. These days it still helps to be at least a little tough; a fiercely blue-collar ethos endures. But instead of abandoning the city, local entrepreneurs and bohemian dreamers alike are sinking roots; opening a wave of funky boutiques, offbeat art galleries and sophisticated restaurants; and injecting fresh life into previously rusted-out spaces. It’s a vibrant spirit best exemplified by Cleveland’s new all-female roller derby league, whose wry name, the Burning River Roller Girls, and home, a former GM auto factory retooled into a 60,000-square-foot sports facility, say it all.

Friday

3 p.m.

1) HELLO CLEVELAND!

Staring at platform shoes worn by Keith Moon or Elvis Presley’s white jumpsuit hardly evokes the visceral excitement of rock music, let alone its rich history, but the Rock and Roll Hall of Fame and Museum (751 Erieside Avenue; 216-781-7625; www.rockhall.com; admission, $22) thankfully has a wealth of interactive exhibits in addition to its displays of the goofier fashion choices of rock stardom. There’s a fascinating look at the genre’s initial 1950s heyday, as well as the hysteria that greeted it — preachers and politicians warning of everything from its incipient Communist subversion to its promotion of wanton sexuality. On the top floors, a well-curated exploration of Bruce Springsteen’s career is on display through next spring.

5 p.m.

2) FROM STEEL TO STYLISH

The steelworkers who once filled the Tremont neighborhood’s low-slung houses and ornately topped churches have largely vanished. A new breed of residents has moved in along with a wealth of upscale restaurants, artisanal shops and galleries showcasing emerging artists. Inside Lilly Handmade Chocolates (761 Starkweather Avenue; 216-771-3333; www.lillytremont.com), you can join the throngs practically drooling over the mounds of freshly made truffles. Or grab a glass at the wine bar inside Visible Voice Books (1023 Kenilworth Avenue; 216-961-0084; www.visiblevoicebooks.com), which features scores of small-press titles, many by local authors.

7 p.m.

3) IRON CHEF, POLISH CLASSIC

Cleveland’s restaurant of popular distinction is Lolita (900 Literary Road; 216-771-5652; www.lolabistro.com), where the owner and “Iron Chef America” regular Michael Symon offers creative spins on Mediterranean favorites including duck prosciutto pizza ($13) and crispy chicken livers with polenta, wild mushrooms and pancetta ($7). (Reservations are recommended.) More traditional comfort food is at Sokolowski’s University Inn (1201 University Road; 216-771-9236; www.sokolowskis.com), a beloved stop for classic Polish dishes since 1923. Even if you’re unswayed by Anthony Bourdain’s description of the smoked kielbasa ($7.25) as “artery busting” (from him, a compliment) at least swing by for the view from the parking lot — a panorama encompassing Cleveland old and new, from the stadiums dotting the downtown skyline to the smoking factories and oddly beautiful slag heaps on the riverside below.

11 p.m.

4) CLASSIC COCKTAILS

One aspect of Tremont has remained steady over the years: it’s a night crawlers’ paradise. Nowadays, discerning drinkers head for the nearby Velvet Tango Room (2095 Columbus Road; 216-241-8869; www.velvettangoroom.com), inside a one-time Prohibition-era speakeasy and seemingly little changed: the bitters are housemade, and the bartenders pride themselves on effortlessly mixing a perfect Bourbon Daisy or Rangpur Gimlet. Yes, as their menu explains, you can order a chocolate-tini — “But we die a little bit every time.”

Saturday

11 a.m.

5) FARM FRESH

Start your day with a visit to the West Side Market (1979 West 25th Street; 216-664-3387; www.westsidemarket.com), where many of the city’s chefs go to stock their own kitchens. Browse over 100 vendors selling meat, cheese, fruit, vegetables and baked goods, or just pull up a chair at Crêpe De Luxe’s counter (www.crepesdeluxe.com) for a savory Montréal (filled with smoked brisket and Emmenthal cheese; $6) or the Elvis homage Le Roi (bananas, peanut butter and chocolate; $5).

2:30 p.m.

6) ART CANVAS

For nearly 20 years the William Busta Gallery (2731 Prospect Avenue; 216-298-9071; www.williambustagallery.com) has remained a conceptual-art-free zone — video installations included. “With video, it takes 15 minutes to see how bad somebody really is,” said Mr. Busta, the gallery’s owner. “With painting, you can spot talent right away.” And that’s predominantly what he exhibits, with a focus on exciting homegrown figures like Don Harvey and Matthew Kolodziej. In the nearby Warehouse District, Shaheen Modern & Contemporary Art (740 West Superior Avenue, Suite 101; 216-830-8888; www.shaheengallery.com) casts a wider geographic net with recent solo exhibits from the buzzy ex-Clevelander Craig Kucia, as well as New York-based artists like Mark Fox and Keith Mayerson.

6 p.m.

7) PARIS ON LAKE ERIE

The most talked about new restaurant this year is L’Albatros (11401 Bellflower Road; 216-791-7880; www.albatrosbrasserie.com), which the chef Zachary Bruell opened last December. Set inside a 19th-century carriage house on the campus of Case Western Reserve University, this inviting brasserie serves impeccably executed French specialties like chicken liver and foie gras mousseline ($9), a niçoise salade ($10) and cassoulet ($22).

8 p.m.

8) BALLROOM BLITZ

The polka bands are long gone from the Beachland Ballroom (15711 Waterloo Road; 216-383-1124; www.beachlandballroom.com), replaced by an eclectic mix of rock groups. But by running a spot that’s as much a clubhouse as it is a concert venue, the co-owners Cindy Barber and Mark Leddy have retained plenty of this former Croatian social hall’s old-school character. Beachland draws local favorites like the avant folkie Bill Fox and post-punkers This Moment in Black History, as well as hot touring acts like Neko Case and the Hold Steady. Mr. Leddy, formerly an antiques dealer, still hunts down finds for the basement’s This Way Out Vintage Shoppe.

Sunday

11 a.m.

9) BEETS, THEN BEATS

One of the few restaurants in town where requesting the vegan option won’t elicit a raised eyebrow, Tommy’s (1824 Coventry Road; 216-321-7757; www.tommyscoventry.com) has been serving tofu since 1972, when the surrounding Coventry Village, in Cleveland Heights, was a hippie oasis. The bloom is off that countercultural rose, but the delicious falafel ($5.79) and thick milkshakes ($4.59) endure. The time warp continues through a doorway leading into Mac’s Backs bookstore (No. 1820; 216-321-2665; www.macsbacks.com), a good place to find out-of-print poetry from Cleveland post-Beat writers like d.a. levy, T. L. Kryss and rjs.

2 p.m.

10) FREE IMPRESSIONISTS

For decades, the University Circle district has housed many of the city’s cultural jewels, including Severance Hall, the majestic Georgian residence of the Cleveland Orchestra; the Cleveland Institute of Art Cinematheque, one of the country’s best repertory movie theaters; and the lush 285-acre Lake View Cemetery. At the Cleveland Museum of Art (11150 East Boulevard; 216-421-7340; www.clemusart.com), already famed for its collection of Old Masters and kid-friendly armor, the June opening of the museum’s Rafael Viñoly-designed East Wing puts the spotlight on more modern fare, moving from a roomful of Impressionists dramatically centered around one of Monet’s “Water Lilies” paintings, up to current work. A visually arresting 2008 drawing by Cleveland’s T. R. Ericsson more than holds its own amidst heavyweight contemporary pieces from Anselm Kiefer and Kiki Smith. A further enticement: admission to the museum’s permanent collection is absolutely free.

THE BASICS

Many major airlines fly nonstop from New York area airports into Cleveland Hopkins International Airport. A recent Web search found round-trip fares for fall flights starting at $239. Although a light rail system connects the airport with both downtown and University Circle, a rental car is advised for reaching most other neighborhoods.

The Marriott Downtown at Key Center (127 Public Square; 216-696-9200; www.marriott.com) is a 25-story, 400-room hotel in the heart of the city. The comfortable, amenity-filled rooms provide quick access to downtown attractions; some feature impressive views of Lake Erie. Doubles start at $159.

A boutique-style option is the Glidden House (1901 Ford Drive; 866-812-4537; www.gliddenhouse.com), 60 quaint rooms in a 1910 French Gothic mansion on the Case Western Reserve University campus, an easy walk to most cultural destinations around University Circle. Doubles from $139.

Tuesday, September 15, 2009

Flats East Bank Project Revived with $54 Million in Public Funding

$54 Million in City, State Funding to Revive Flats East Bank Project

by Michelle Jarboe

The Cleveland Plain Dealer

Buildings could start rising next spring at the stalled Flats East Bank development in Cleveland, now that the city and state have earmarked $54 million in loans and grants to get the project moving again.

The new funding will enable developers to start work on a slimmed-down, $270 million first phase of the waterfront project -- including an office tower to house accounting firm Ernst & Young and law firm Tucker Ellis & West. The first phase of the project also will include a hotel, stores, restaurants, a health club and 14 acres of public parks and green space. It could be complete by spring 2012.

The city and state financing is a life raft for the Flats, which sputtered in the wake of last fall's financial crisis. But the importance of public money in reviving the project shows just how difficult it is to find private financing for development. Projects across the country are still tabled as banks and other lenders shy away from new construction and curtail their lending on existing shopping centers, office buildings and industrial parks.

To jump-start the Flats, the state has committed $24 million -- $23 million of which comes in the form of loans. Of that package, a $3.2 million loan to the city of Cleveland already has been approved. The state has yet to approve $20 million in loans and a $1 million grant, according to the department of development. State boards and committees could sign off on that financing within the next two months.

Cleveland's economic development department plans to introduce legislation to City Council to provide a $30 million loan to the project. That loan, which could run for 20 years at a 3 percent interest rate, would come to the city through the U.S. Department of Housing and Urban Development.

The city also plans to approve use of its $25 million Recovery Zone Bond allocation from the federal government for the project. That allocation -- part of the federal stimulus program -- makes it possible for otherwise taxable bonds to be issued as tax-exempt bonds. In this case, bonds issued for the project by the state and the Cleveland-Cuyahoga Port Authority would be tax-exempt and would carry lower interest rates.

Friday, September 11, 2009

Don't Miss the Ohio City Blues Fest on Saturday, Sept. 19th

Check out the second annual Ohio City Blues Fest on Saturday, September 19, at Wendy Park on Whiskey Island.

Come hear six fantastic blues acts and enjoy a wide range of craft and import beers, wine and food for purchase. Tickets for admission to the festival are just $15 in advance or $20 at the door. Children under 10 are free. Tickets are on sale now. Capacity is limited to the first 2,000 attendees.

The event, which benefits Ohio City Near West Development Corporation and the Wendy Park Foundation, kicks off at 2:00 p.m. with a special acoustic set by Jeff Powers, followed by Memphis Cradle. The Colin Dussault Blues Project, the self-proclaimed “hardest-working band in Northeast Ohio," makes a return appearance to the Ohio City line-up, and are followed by local favorites the Armstrong-Bearcat Band. Walkin' Cane and his band keep the evening jamming until the closing set by the Blues Disciples, a Milwaukee-based quintet making their Cleveland debut.

The performance schedule is as follows:

2:00-2:30: Jeff Powers

3:00-4:00: Memphis Cradle

4:30-5:30 p.m.: Colin Dussault Blues Project

6:00-7:00 p.m.: Armstrong-Bearcat Band

7:30-9:00 p.m.: Walkin’ Cane

9:30 p.m.-11:00 p.m.: Blues Disciples

VIP tickets are available for $50 per person. With a VIP ticket, you gain access to the Ohio City Blues Fest “VIP Mound.” This elevated seating area in the middle of the concert venue gives you a clear view of the stage without obstructions from the people in front of you. Plus, you get your own seat and table so there’s no need to lug your own to the venue, and you get a free 2009 Ohio City Blues Fest event t-shirt. And, best of all, you have tableside wait service so you don’t ever have to leave your seat for food and beverage.

All this for just $50 per person.

Capacity in the VIP Mound is limited to the first 20 people, so order your tickets today by calling 216.781.3222 (sorry, no online ordering is available for these special tickets).

In addition to the music, Cleveland Plays will sponsor a volleyball tournament from 1:00 – 5:00 p.m. at the Wendy Park sand courts adjacent to the music venue. All participants in the tournament receive admission to the festival. For more information on the tourney, contact Cleveland Plays.

This year’s sponsors include Cinecraft Productions, Lutheran Hospital, Great Lakes Brewing Company, Progressive Urban Real Estate, Chisholm & Associates, Ampco System Parking, Dave’s Supermarket, Fat Fish Blue, Stone Gables Bed & Breakfast, Cleveland Plays, Ohio City Pasta and Councilman Joe Cimperman.

To keep abreast of the latest on the Ohio City Blues Fest, join the event's Facebook page.

Friday, September 4, 2009

One Man's Trash ...

Published in the NY Times, 9/2/09

AMONG the traditional brick and clapboard structures that line the streets of this sleepy East Texas town, 70 miles north of Houston, a few houses stand out: their roofs are made of license plates, and their windows of crystal platters.

They are the creations of Dan Phillips, 64, who has had an astonishingly varied life, working as an intelligence officer in the Army, a college dance instructor, an antiques dealer and a syndicated cryptogram puzzle maker. About 12 years ago, Mr. Phillips began his latest career: building low-income housing out of trash.

In 1997 Mr. Phillips mortgaged his house to start his construction company, Phoenix Commotion. “Look at kids playing with blocks,” he said. “I think it’s in everyone’s DNA to want to be a builder.” Moreover, he said, he was disturbed by the irony of landfills choked with building materials and yet a lack of affordable housing.

To him, almost anything discarded and durable is potential building material. Standing in one of his houses and pointing to a colorful, zigzag-patterned ceiling he made out of thousands of picture frame corners, Mr. Phillips said, “A frame shop was getting rid of old samples, and I was there waiting.”

So far, he has built 14 homes in Huntsville, which is his hometown, on lots either purchased or received as a donation. A self-taught carpenter, electrician and plumber, Mr. Phillips said 80 percent of the materials are salvaged from other construction projects, hauled out of trash heaps or just picked up from the side of the road. “You can’t defy the laws of physics or building codes,” he said, “but beyond that, the possibilities are endless.”

While the homes are intended for low-income individuals, some of the original buyers could not hold on to them. To Mr. Phillips’s disappointment, half of the homes he has built have been lost to foreclosure — the payments ranged from $99 to $300 a month.

Some of those people simply disappeared, leaving the properties distressingly dirty and in disrepair. “You can put someone in a new home but you can’t give them a new mindset,” Mr. Phillips said.

Although the homes have resold quickly to more-affluent buyers, Mr. Phillips remains fervently committed to his vision of building for low-income people. “I think mobile homes are a blight on the planet,” he said. “Attractive, affordable housing is possible and I’m out to prove it.”

Freed by necessity from what he calls the “tyranny of the two-by-four and four-by-eight,” common sizes for studs and sheets of plywood, respectively, Mr. Phillips makes use of end cuts discarded by other builders — he nails them together into sturdy and visually interesting grids. He also makes use of mismatched bricks, shards of ceramic tiles, shattered mirrors, bottle butts, wine corks, old DVDs and even bones from nearby cattle yards.

“It doesn’t matter if you don’t have a complete set of anything because repetition creates pattern, repetition creates pattern, repetition creates pattern,” said Mr. Phillips, who is slight and sinewy with a long gray ponytail and bushy mustache. He grips the armrests of his chair when he talks as if his latent energy might otherwise catapult him out of his seat.

Phoenix Commotion homes meet local building codes and Mr. Phillips frequently consults with professional engineers, electricians and plumbers to make sure his designs, layouts and workmanship are sound. Marsha Phillips, his wife of 40 years and a former high school art teacher, vets his plans for aesthetics.

“He doesn’t have to redo things often,” said Robert McCaffety, a local master electrician who occasionally inspects Mr. Phillips’s wiring. “He does everything in a very neat and well thought-out manner.” Describing Huntsville as a “fairly conservative town,” Mr. McCaffety said, “There are people who think his houses are pretty whacked out but, by and large, people support what he does and think it’s beneficial to the community.”

Indeed, city officials worked closely with Mr. Phillips in 2004 to set up a recycled building materials warehouse where builders, demolition crews and building product manufacturers can drop off items rather than throwing them in a landfill. There’s no dumping fee and donations are tax deductible because the materials are used exclusively by charitable groups or for low-income housing.

“I’ve been recycling all my life, and it never occurred to me to recycle a door,” said Esther Herklotz, Huntsville’s superintendent of solid waste. “Dan has changed the way we do things around here.”

Officials in Houston also consulted with Mr. Phillips before opening a similar warehouse this summer, and other cities, including Bryan, Tex.; Denham Springs, La.; and Indianapolis have contacted him to inquire how to do the same.

Phoenix Commotion employs five minimum-wage construction workers but Mr. Phillips also requires the labor of the home’s eventual resident — he tends to favor a poor, single mother because his own father walked out on him and his mother when he was 17, which left them in a tough financial situation. “My only requirement is that they have good credit or no credit but not bad credit,” he said.

One of his houses belongs to Gloria Rivera, a cashier at a doughnut shop, who built the home with Mr. Phillips and her teenage son in 2004. Before then, she lived in a rented mobile home. Constructed almost entirely out of salvaged and donated materials, the 600-square-foot wooden house is painted royal blue with various squares of red, maroon and fuchsia tile glued to the mismatched gingerbread trim.

Inside, there is imported Tuscan marble on the floor, though the tiles are not of uniform size, and bright yellow stucco walls that Ms. Rivera said she textured using her thumb. “It’s not perfect but it’s mine,” Ms. Rivera said, touching the stucco, which looks like very thick and very messy butter cream frosting. “I call it my doll house.”

Phoenix Commotion homes lost to foreclosure have resold to middle-class buyers who appreciate not only their individuality but also their energy efficiency, which is also part of Mr. Phillips’s construction philosophy.

Susan Lowery and Alfredo Cerda, who both work for the United States Department of Homeland Security, bought a Phoenix Commotion house after the intended low-income owner couldn’t manage the mortgage. It has mosaics on the walls and counters made of shards of broken tile and cushy flooring made out of wine corks. “My wife likes the house because it doesn’t look like everyone else’s, but, being a guy, what I like is that it has a galvanized metal roof that I’ll never have to replace,” Mr. Cerda said.

Mr. Phillips said it bothered him when his low-income housing became “gentrified.” But if it leads to an acceptance of recycled building materials and a shift away from cookie-cutter standardized construction, he said, “I’m O.K. with it.”

Although it has a social agenda, Phoenix Commotion is not a nonprofit. “I want to show that you can make money doing this,” Mr. Phillips said.

He said he earned enough to live on but he was not getting rich. While he declined to be more specific, he allowed that the business has become more profitable as he has gained construction experience. It now takes six months to build a home rather than the 18 months it took when he started.

But Mr. Phillips said his biggest reward was giving less-fortunate people the opportunity to own a home and watching them develop a sense of satisfaction and self-determination in the course of building it.

An example is Kristie Stevens, a single mother of two school-age sons who earned a college degree last spring while working part time as a restaurant and catering manager. She has spent the months since graduation hammering away on what will be her home.

“If something goes wrong with this house, I won’t have to call someone to fix it because I know where all the wires and pipes are — I can do it myself,” she said. “And if the walls are wonky, it will be my fault but also my pride.”

Wednesday, August 26, 2009

Entrepreneurs for Sustainability Highlighted in Business Week

(Image courtesy of A Piece of Cleveland, http://www.apieceofcleveland.org)

Cleveland's Green-Thinking Entrepreneurs

With the nonprofit Entrepreneurs for Sustainability as a catalyst, several startups are finding creative ways to put green principles to work

By Emily Schmitt

The entrepreneurs of Cleveland are hoping that next time you think of their city, you'll think "green" (rather than thinking of, say, the Cuyahoga River on fire). At the forefront of Cleveland's green thinking is a nonprofit called Entrepreneurs for Sustainability (E4S), which educates and trains business owners on practices that will help them make their companies more sustainable. The group was founded in 2000 by Holly Harlan, a former industrial engineer for John Deere, and three entrepreneurs: Pete Acorti, Brian Schneiderman, and Grant Marquit.

Harlan, now the president of E4S, got the idea for the group after a stint at the Rocky Mountain institute, where she studied capitalism and its environmental impact. The first meeting of E4S drew 25 business owners, but today the group boasts over 7,000 individual members, and its monthly meetings, where business owners gather to hear a guest speaker discuss a sustainable business practice, often draw about 150 people. Ultimately, the goal of E4S is not only to help companies become more environmentally conscious but also to help them save money.

Companies of all sizes are welcome, but the focus remains on entrepreneurs. "We started out with just entrepreneurs, but we attracted everyone. All are leaders interested in putting sustainability to work," says Harlan. In a July 2008 survey, 70% of E4S members said their company had a waste reduction goal; 60% had energy efficiency goals; and 30% intended to reduce their carbon levels.

Using the Waste Stream

Several creative, environmentally conscious startups have sprung from E4S. Mike Dungan, an E4S board member, and Mike Thomas, who had been a waste-stream consultant, were particularly influenced by an August 2007 meeting at which consultant Janine Benyus spoke about the benefits of biomimicry, or the practice of studying patterns in nature and applying them to everyday problems. Dungan and Thomas were particularly taken with the habits of honeybees, who find resources (in their case, nectar) in faraway places and transmit that knowledge back to others that can help harvest it. In 2009, Thomas and Dungan founded BeeDance to try to model that information sharing and local collaboration in a for-profit company. Their first project, called Zero Landfill, collects carpet samples from architectural firms and gives them to elementary schools and animal shelters, where they can be reused.

A Piece of Cleveland (APOC), founded in 2008 by Chris Kious, Aaron Gogolin and P.J. Doran, also credits E4S for its formation. The company dismantles abandoned houses slated for demolition. APOC, which generally brings in about $10,000 per contract and employs between 8 and 20 people part-time, uses reclaimed materials from the houses to make furniture. "We're looking to dip our hands into the waste stream and put [materials] back into the community," says Kious, who previously worked in community development and says E4S has helped him to meet other business owners. Last year APOC constructed countertops and tables from reclaimed wood for a local Starbucks.

E4S will showcase eight local startups this month. The startups will present their goals and talk to local business owners about how to best reach them. The city itself is also getting on the green train. This August, Mayor Frank G. Jackson will host a three-day summit to outline how Cleveland will meet its goal of becoming sustainable by 2019, a step in the direction of becoming what the mayor is promoting as a "green city on a blue lake."

Friday, August 21, 2009

It's a Family Affair: Developers Tackle Historic Rehab on Lorain Avenue

Michael Fleming first noticed the solid brick façade and big, storefront windows of the former Oddfellows Hall on Lorain Avenue when he was training for a marathon. Wedged between a storefront church and a biker shop, the building seemed like a diamond in the rough.

“I was running one day, and the building jumped out at me,” says Fleming. “Lorain may be shabby and a bit down-at-the-heels, but it’s a very pretty street, and it’s affordable.”

Fleming saw that the property was for sale, and one day he ventured inside. The first thing he saw was the mahogany bar, covered in dust. That’s when he fell in love.

“I’ve always wanted to live above a bar,” says Fleming, who worked as a chef in Boston and Miami before moving back to Cleveland, his hometown, to pursue development in 2005.

Last year, Fleming bought the Ohio City building for $150,000 with his dad, his mom and his brother. The family members formed Solo Development LLC to invest in Cleveland real estate. They plan to renovate the first floor storefront and turn the upper two stories into loft apartments. Michael and his brother David will move into two of the apartments, and rent out the third.

“We are making an investment in the center of Cleveland,” says Ken Fleming, Michael's father. “Since we purchased the building, we’ve seen other new developments sprout along Lorain.”

Ken Fleming cited over $16 million in investment on Lorain Avenue, including such projects as the St. Ignatius Performing Arts Facility, Providence House Campus expansion, the D.H. Ellison Company, the Cleveland Environmental Center, and the United Office Building.

The Flemings’ development was financed by Western Reserve Bank in Brecksville, in partnership with Cleveland Action to Support Housing (CASH), a non-profit whose mission is to provide low-interest loans to help spur reinvestment in Cleveland neighborhoods.

“We helped to finance the project at a reduced interest rate,” says Marcia Nolan, Executive Director of CASH. “We made deposits with Western Reserve Bank, and this enabled the borrower to save money.” She added, “Our work helps to make projects like this feasible.”

The developers will spend an additional $275,000 to create apartments in the building. The units will have a contemporary, loft-like feel, and will include such amenities as new kitchens and baths, in-suite laundry, and open floor plans. The third floor – which was originally used as a ballroom in its heyday, and has fourteen foot ceilings – is being transformed into a two bedroom, loft apartment. Michael plans to move into the apartment when it’s finished.

Renovating the building has turned into a family project. “My dad, my brother and I came down on Saturday mornings to tear apart the old plaster and lath from the walls and ceiling,” says Michael Fleming. “We spent about four months doing that before hiring a crew.”

During the redevelopment, the developers have coped with many challenges, including moving walls and reconfiguring electrical and plumbing systems. Michael is determined to restore the cove ceilings in the old ballroom, which were badly damaged by a leaky roof.

“Rehab is like peeling off layers of an onion,” Michael says with a laugh. “It’s a good learning experience.”

The Oddfellows building, which was built in 1870, has a rich, varied history. Over the years, it has housed the Hungarian Men’s Singing Society, the Communist Party of Northeast Ohio, and a hardcore music club called “Speak in Tongues,” among others.